examples of customer satisfaction survey questions 2025

Understanding your customers is the cornerstone of any successful organisation. But how do you move beyond guesswork and gather truly insightful feedback that drives growth? The answer lies in asking the right questions, organised in a way that encourages a response. A well-crafted survey is more than a simple form; it's a strategic tool for uncovering valuable insights into the customer experience.

This guide provides a comprehensive list of powerful examples of customer satisfaction survey questions, each chosen for its ability to deliver actionable data. We will not just list the questions; we will dissect them. For each example, you will find a strategic breakdown of why it works, what it measures, and how you can implement it effectively. We’ll explore everything from measuring overall loyalty with Net Promoter Score (NPS) to pinpointing specific friction points with a Customer Effort Score (CES).

By the end of this article, you will be equipped to build surveys that don't just collect data, but spark meaningful improvements and foster lasting customer relationships. It's time to unlock the voice of your customer and transform your feedback strategy from a simple task into a powerful engine for loyalty and retention. You can start collecting this vital feedback today with a tool like Goodkudos, designed to make the process simple and effective.

1. Net Promoter Score (NPS) Question

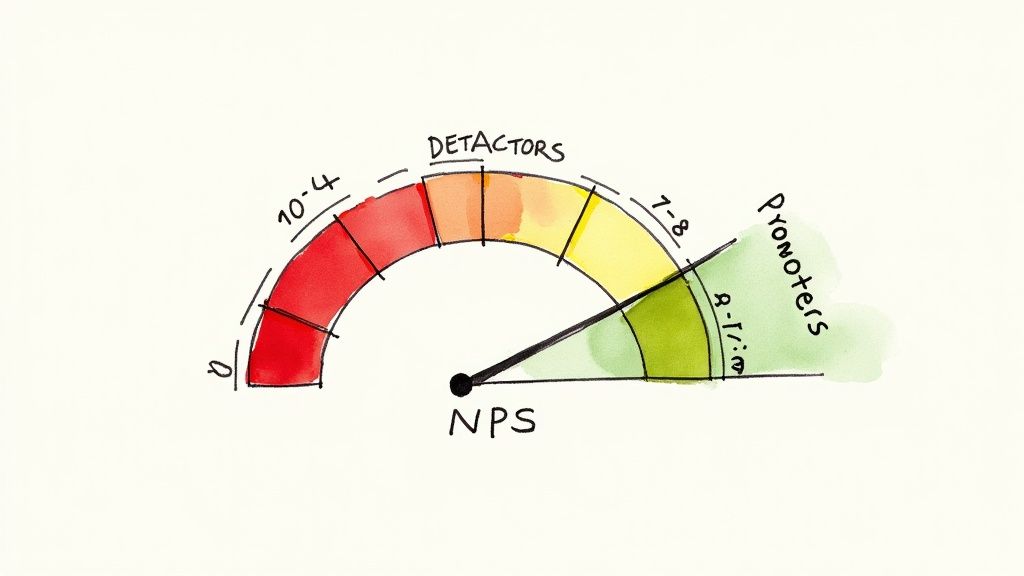

The Net Promoter Score (NPS) is a widely adopted metric designed to gauge customer loyalty and predict business growth. It revolves around a single, powerful question: “On a scale of 0 to 10, how likely are you to recommend our [company/product/service] to a friend or colleague?” This simple query, popularised by Fred Reichheld, classifies customers into three distinct groups.

Based on their response, customers are categorised as Promoters (score 9-10), who are enthusiastic advocates; Passives (score 7-8), who are satisfied but not loyal; and Detractors (score 0-6), who are unhappy and can damage your brand. The final NPS is calculated by subtracting the percentage of Detractors from the percentage of Promoters.

Why It's a Top-Tier Question

The NPS question is one of the most effective examples of customer satisfaction survey questions because it measures more than just satisfaction; it measures advocacy. A customer might be satisfied with a transaction but not loyal enough to recommend you. NPS cuts through this ambiguity to provide a clear indicator of brand health. Companies like Apple and Netflix use it relentlessly to maintain their market leadership.

Strategic Tips for Implementation

To get the most value from your NPS survey, follow these best practices:

- Ask "Why?": Always include an open-ended follow-up question, such as "What is the primary reason for your score?" This provides crucial qualitative context.

- Track Trends: Monitor your NPS over time to spot trends and measure the impact of your initiatives.

- Segment Your Data: Analyse NPS scores by customer demographic, purchase history, or location to uncover deeper insights.

- Close the Loop: Respond directly to Detractors to resolve their issues and act on feedback from Promoters to amplify what you're doing right.

By integrating NPS into your feedback strategy, you can gather actionable data to reduce churn and fuel growth. Ready to start measuring customer loyalty? GoodKudos makes it simple to create and send NPS surveys.

2. Customer Satisfaction (CSAT) Rating Question

The Customer Satisfaction (CSAT) score is a fundamental metric used to measure a customer's happiness with a specific interaction, product, or service. It asks a direct question, such as: “How satisfied were you with your [recent purchase/support experience/delivery]?” This query typically uses a 3, 5, or 7-point rating scale, ranging from “Very Unsatisfied” to “Very Satisfied”.

Unlike broader loyalty metrics, CSAT provides an in-the-moment snapshot of a specific touchpoint in the customer journey. The final score is calculated as the percentage of respondents who rated their experience as “Satisfied” or “Very Satisfied” (e.g., scores of 4 or 5 on a 5-point scale). This focused feedback is invaluable for pinpointing operational strengths and weaknesses.

Why It's a Top-Tier Question

The CSAT question is one of the most effective examples of customer satisfaction survey questions because of its directness and simplicity. It provides immediate, actionable feedback on distinct events, such as a support call or a recent delivery. This allows organisations to quickly identify and address service failures. Retail and hospitality giants frequently use CSAT surveys post-interaction to maintain high service standards and improve employee performance.

Strategic Tips for Implementation

To maximise the value of your CSAT surveys, consider these best practices:

- Time It Right: Send the survey immediately after the interaction has concluded to ensure the experience is fresh in the customer’s mind.

- Be Specific: Frame the question around a single, specific experience (e.g., "your recent call with our support team") rather than their overall satisfaction.

- Ask for Context: Include an optional open-ended field like "Could you tell us a bit more about why you chose that score?" to gather qualitative insights.

- Benchmark Channels: Track and compare CSAT scores across different channels, such as email support, live chat, and phone calls, to identify performance gaps.

By implementing CSAT surveys effectively, you can gather crucial data to enhance individual customer experiences. To start collecting this targeted feedback, GoodKudos offers intuitive tools to build and deploy CSAT surveys effortlessly.

3. Customer Effort Score (CES) Question

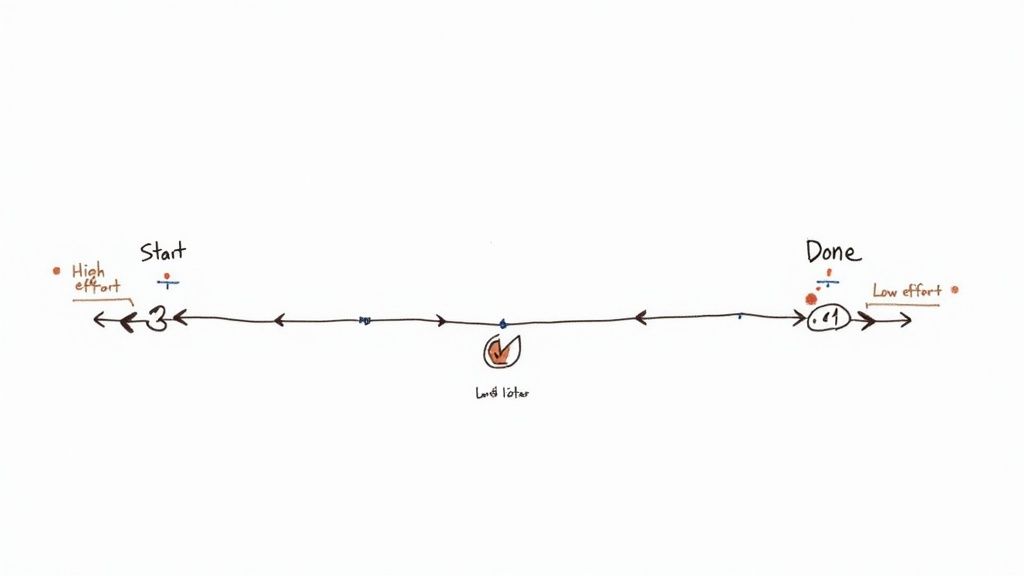

The Customer Effort Score (CES) is a powerful transactional metric that measures how much effort a customer had to expend to get an issue resolved, a request fulfilled, or a question answered. The core question is typically phrased as: “To what extent do you agree with the following statement: The company made it easy for me to handle my issue?” on a scale of 1 (Strongly Disagree) to 7 (Strongly Agree).

Popularised by research from CEB (now Gartner), the premise is that reducing customer effort is a more reliable predictor of loyalty than simply delighting customers. By focusing on ease and efficiency, businesses can significantly reduce customer friction and improve retention. A low-effort experience is a key driver of positive sentiment and repeat business.

Why It's a Top-Tier Question

CES is one of the most practical examples of customer satisfaction survey questions because it directly pinpoints friction in the customer journey. While satisfaction can be subjective, effort is a tangible pain point. Companies like Adobe use CES insights to simplify complex processes like software onboarding, directly improving the user experience. This focus on "effortless" interactions is crucial for building a loyal customer base.

Strategic Tips for Implementation

To effectively leverage CES and reduce customer friction, consider these best practices:

- Deploy Immediately: Ask the CES question right after a specific interaction, such as a support call or a purchase, to capture accurate, top-of-mind feedback.

- Prioritise High-Effort Journeys: Analyse your feedback to identify which interactions cause the most customer effort and prioritise those for improvement.

- Combine with "Why?": Just like NPS, pair your CES question with an open-ended follow-up to understand the reasons behind a high-effort score.

- Track Performance: Monitor your CES score over time to measure the impact of process improvements and operational changes on the customer experience.

By implementing CES, you can identify and eliminate obstacles, creating smoother experiences that keep customers coming back. GoodKudos provides the tools you need to easily measure Customer Effort Score and gather actionable feedback.

4. Product Quality Rating Question

This question type is designed to directly measure a customer's perception of your product's quality, isolating it from other aspects of their experience like service or delivery. It typically asks a direct question, such as: “How would you rate the quality of [Product Name]?”, often using a 1-5 or 1-10 scale. This query is a cornerstone of quality management, popularised by frameworks like Total Quality Management (TQM).

The responses provide a clear, quantifiable metric on product performance. For instance, an automotive company can use it to assess vehicle build quality, while a software firm might gauge the reliability and performance of its application. It allows businesses to pinpoint specific product strengths or weaknesses.

Why It's a Top-Tier Question

A product quality rating is one of the most fundamental examples of customer satisfaction survey questions because it provides direct feedback on the core offering. While overall satisfaction is important, this question zooms in on the tangible item the customer purchased. It helps businesses quickly identify manufacturing defects, design flaws, or unmet performance expectations. Companies in consumer electronics and manufacturing rely on this data to maintain high standards and reduce returns.

Strategic Tips for Implementation

To maximise the value of your product quality rating questions, implement these best practices:

- Ask about specific attributes: Follow up with questions about distinct features like durability, design, ease of use, or performance to get more granular insights.

- Correlate with internal data: Compare customer quality ratings against your internal data, such as defect rates or returns information, to validate perceptions with reality.

- Track quality over time: Monitor ratings for specific products across different production batches or software updates to ensure consistency and measure the impact of improvements.

- Segment your results: Analyse the data by different customer segments or regions to identify if quality perception varies among different groups.

By focusing on product quality, you can gather the precise data needed to refine your offerings and build a reputation for excellence. GoodKudos offers versatile survey tools to help you track product quality and other key metrics.

5. Customer Service Responsiveness Question

A customer's perception of your support quality is heavily influenced by how quickly they receive help. The customer service responsiveness question directly measures this, evaluating the speed and efficiency of your support team's replies. It often takes the form of: “How would you rate the speed of our customer service response?” or “Did our support team resolve your query in a timely manner?”

This metric, popularised by Service Level Agreement (SLA) standards, is crucial for understanding your operational efficiency. It helps distinguish between First Response Time (how quickly you first acknowledge a customer) and Resolution Time (how long it takes to solve their problem). Both are vital for maintaining high satisfaction levels.

Why It's a Top-Tier Question

Responsiveness is a cornerstone of a positive customer experience. This query is one of the most practical examples of customer satisfaction survey questions because it provides a clear, actionable benchmark for your support operations. A slow response can frustrate even the most loyal customer, making this a critical metric to track. Help desk systems and SaaS companies rely on this data to optimise their support workflows and meet customer expectations.

Strategic Tips for Implementation

To effectively measure and improve your team's responsiveness, consider these best practices:

- Define Clear Targets: Establish realistic internal goals for first-response and resolution times based on the channel (e.g., live chat vs. email).

- Segment by Channel: Analyse response times across all your support channels (phone, email, social media) to identify bottlenecks.

- Correlate with CSAT: Compare responsiveness data with overall satisfaction scores to understand the direct impact of speed on customer happiness.

- Automate to Acknowledge: Use automated replies to instantly acknowledge receipt of a customer's query, managing expectations while a human agent becomes available.

By focusing on responsiveness, you can significantly enhance your service quality and build customer trust. GoodKudos offers tools to help you track this and other key support metrics effortlessly.

6. Value for Money / Price Perception Question

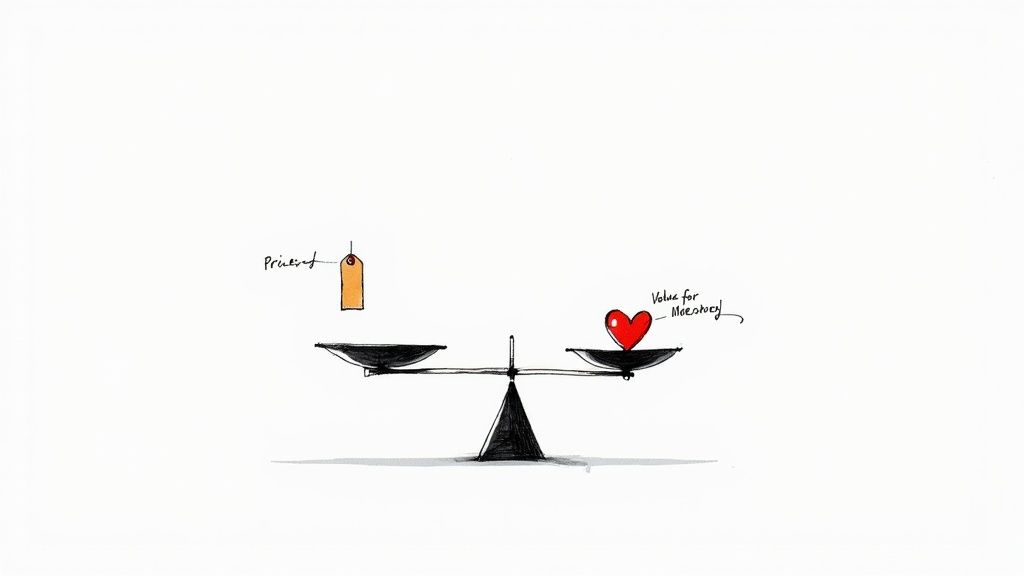

Understanding whether customers believe they are receiving fair value is crucial for pricing strategies and brand positioning. This question directly assesses the customer's perception of your product or service's worth relative to its cost, often phrased as: “How would you rate the value for money of the [product/service]?” or “Considering the price you paid, how would you describe the value you received?”

This query helps you understand if your pricing aligns with the perceived benefits, a key factor in both customer acquisition and retention. It reveals whether you are positioned as a premium offering, a budget-friendly option, or somewhere in between, directly in the eyes of your customers.

Why It's a Top-Tier Question

The price perception question is one of the most practical examples of customer satisfaction survey questions because it connects satisfaction directly to revenue. A customer can be happy with a product's quality but feel it was overpriced, leading to churn. Luxury brands use this to ensure their premium price feels justified, while subscription services like Spotify use it to ensure their monthly fee continues to feel like a great deal. This feedback is essential for staying competitive.

Strategic Tips for Implementation

To gain maximum insight from your price perception questions, follow these best practices:

- Segment Your Data: Analyse responses based on customer demographics or subscription tiers to see how value perception differs across your audience.

- Track Over Time: Monitor how value perception changes after price adjustments, feature updates, or competitor moves.

- Contextualise with "Why?": Use a follow-up question like "Could you tell us why you gave that rating?" to understand the drivers behind their perception.

- Correlate with Other Metrics: Link value perception scores to churn rates and loyalty metrics like NPS to identify customers at risk.

By systematically evaluating price perception, you can fine-tune your pricing strategy to maximise both customer satisfaction and profitability. GoodKudos offers customisable surveys to help you gather this vital feedback effortlessly.

7. Feature/Functionality Satisfaction Question

To innovate effectively, you need to understand which parts of your product resonate most with users. The feature/functionality satisfaction question is designed to measure customer sentiment towards specific aspects of your product or service. It asks directly: “How satisfied are you with [specific feature]?” or “Does the product have the features you need?” This approach, popularised by agile product development, helps prioritise roadmap decisions.

This question moves beyond general satisfaction to provide granular, actionable feedback. By isolating individual features, companies can identify which elements drive value and which ones are causing friction. For example, Slack frequently surveys users on specific messaging features, while Microsoft tracks satisfaction with individual functions in Excel to guide future updates.

Why It's a Top-Tier Question

This query is one of the most practical examples of customer satisfaction survey questions for product teams. It directly links customer feedback to the development cycle, helping to allocate resources efficiently. Instead of guessing what users want, you get clear data on what to improve, what to build next, and what might be obsolete. It helps bridge the gap between feature availability and actual user happiness.

Strategic Tips for Implementation

To turn feature feedback into a powerful development tool, follow these best practices:

- Ask About Features Individually: Avoid bundling multiple features into one question to get clear, unambiguous data for each one.

- Combine with Usage Data: Cross-reference satisfaction scores with actual usage analytics. A low-use, low-satisfaction feature may be a candidate for removal.

- Prioritise High-Impact Areas: Focus your development efforts on features that are highly important to users but currently have low satisfaction scores.

- Distinguish Presence from Usability: Ask separate questions about whether a feature exists versus how easy it is to use.

By systematically gathering this feedback, you can build a product that truly meets customer needs. GoodKudos can help you create targeted surveys to measure satisfaction with every feature.

8. Likelihood to Repurchase Question

The likelihood to repurchase question is a forward-looking metric that directly assesses a customer's intention to buy from your business again. It is typically phrased as: “How likely are you to purchase from us again in the future?” and presented with a scale, such as 1 (not at all likely) to 5 (extremely likely). This question is a powerful leading indicator of customer retention and future revenue.

Unlike satisfaction questions that reflect past experiences, this query focuses on future behaviour. A high repurchase likelihood score suggests that customers see long-term value in your offerings, making it a crucial metric for predicting customer lifetime value (CLV) and sustainable growth. E-commerce stores often use this question post-purchase to forecast repeat business and identify at-risk customers.

Why It's a Top-Tier Question

This query is one of the most practical examples of customer satisfaction survey questions because it connects feedback directly to revenue. While satisfaction is important, the intention to spend money again is a more tangible measure of business health. It helps you understand the direct commercial impact of the customer experience, allowing you to prioritise improvements that will boost your bottom line.

Strategic Tips for Implementation

To effectively use the repurchase likelihood question, consider these best practices:

- Time It Right: Send this survey 2-4 weeks after a purchase to give the customer enough time to experience the product or service fully.

- Segment the Data: Analyse repurchase intent by product category, customer demographic, or initial purchase value to find patterns.

- Identify Barriers: For customers with low repurchase intent, use an open-ended follow-up like "What could we do to encourage you to purchase from us again?" to uncover specific obstacles.

- Correlate with Other Metrics: Compare repurchase scores against NPS and CSAT data to build a comprehensive picture of the customer journey and identify key drivers of loyalty.

By focusing on repurchase intent, you can gather actionable insights to improve retention. GoodKudos can help you deploy these targeted surveys to understand and increase customer loyalty.

9. Company/Brand Trust and Credibility Question

Trust is the foundation of any lasting customer relationship, and this question is designed to measure it directly. It typically asks something like: “On a scale of 1 to 5, how much do you trust [Your Company Name] to deliver on its promises?” This query moves beyond transactional satisfaction to assess the customer’s faith in your brand’s integrity and reliability.

Measuring trust is fundamental to building brand equity. A high trust score indicates that customers feel secure in their relationship with you, believe in your mission, and are more likely to remain loyal during challenging times. Industries where this is paramount, such as finance, healthcare, and insurance, rely on this metric to gauge their reputation and stability.

Why It's a Top-Tier Question

This is one of the most critical examples of customer satisfaction survey questions because trust directly influences long-term loyalty and purchase decisions. While a customer might be satisfied with a single product, a lack of trust in the company can prevent repeat business. For small businesses and freelancers, establishing credibility is a key differentiator that turns one-time clients into long-term partners.

Strategic Tips for Implementation

To effectively measure and build brand trust, consider these best practices:

- Ask for the 'Why': Follow up with an open-ended question like "What is the main reason you feel this way?" to uncover the specific drivers (or destroyers) of trust.

- Monitor During Crises: Track trust scores closely during service outages, public relations challenges, or market shifts to manage your brand's reputation proactively.

- Benchmark Your Position: If possible, compare your trust scores against industry benchmarks or key competitors to understand your standing in the market.

- Connect to Outcomes: Analyse how trust scores correlate with business outcomes like customer lifetime value, retention rates, and referral frequency.

By systematically measuring trust, you can identify vulnerabilities and reinforce the qualities that build a resilient and reputable brand. To start building stronger customer relationships, GoodKudos provides the tools to measure and act on these crucial insights.

10. Overall Satisfaction / Recommendation Likelihood Combination Question

This dual-pronged approach combines two critical customer sentiment metrics: overall satisfaction and likelihood to recommend. While often presented as two distinct questions back-to-back on a Likert scale, they work in tandem to create a holistic view of the customer experience. For example, a survey might ask, "Overall, how satisfied are you with our service?" immediately followed by, "How likely are you to recommend us to others?"

This method, popularised by market research firms like Forrester, captures both a customer's personal feeling (satisfaction) and their public endorsement potential (advocacy). A high satisfaction score doesn't always translate into a recommendation, and this combination helps uncover that crucial nuance.

Why It's a Top-Tier Question

This combination stands out among examples of customer satisfaction survey questions because it provides a more stable and comprehensive measure of customer sentiment. While NPS focuses purely on advocacy, this pairing gives you a broader diagnostic tool. It helps you understand if your service is merely meeting needs or creating genuine brand champions. B2B companies, in particular, use this in annual account reviews to gauge overall relationship health.

Strategic Tips for Implementation

To maximise the value of this combined questioning, consider these best practices:

- Separate the Questions: Although they measure related concepts, present them as two distinct questions to avoid respondent confusion and ensure clear data.

- Use in Comprehensive Surveys: This approach is best suited for periodic, in-depth surveys (like annual reviews), rather than brief, transactional feedback forms.

- Segment Your Analysis: Analyse the relationship between satisfaction and recommendation scores across different customer segments to identify at-risk groups or highly loyal cohorts.

- Follow Up with Specifics: After these general questions, ask about specific attributes (e.g., product quality, support speed) to understand the drivers behind the scores.

By using this powerful combination, you can gain a more rounded understanding of customer loyalty. GoodKudos allows you to easily build these multi-question surveys and analyse the results.

10 Customer Satisfaction Survey Questions Compared

| Metric | 🔄 Implementation Complexity | ⚡ Resource Requirements | 📊⭐ Expected Outcomes | 💡 Ideal Use Cases | ⭐ Key Advantages |

|---|---|---|---|---|---|

| Net Promoter Score (NPS) Question | Low 🔄 — single standardized question | Low ⚡ — minimal tooling, regular sampling | Predicts loyalty/advocacy and growth; benchmarkable 📊⭐ | Relationship-level tracking, cross-company benchmarking | Predictive of revenue, scalable, easy to interpret |

| Customer Satisfaction (CSAT) Rating Question | Low 🔄 — one transactional question | Low ⚡ — immediate post-interaction sends | Immediate satisfaction snapshot; operational feedback 📊 | Post-purchase or support interactions, quick fixes | Fast, easy to collect, actionable for specific transactions |

| Customer Effort Score (CES) Question | Low–Medium 🔄 — timing critical after task | Low–Medium ⚡ — needs event-triggered surveys | Identifies friction; strong loyalty predictor when reduced 📊⭐ | Task/process optimization, support flows, onboarding | Highlights operational pain points; drives simplification |

| Product Quality Rating Question | Medium 🔄 — product‑specific design | Medium ⚡ — integration with QA/product analytics | Detects defects/trends; guides R&D and QA improvements 📊 | Manufacturing, e‑commerce, product improvement cycles | Directly actionable for product teams; links to business impact |

| Customer Service Responsiveness Question | Medium 🔄 — requires channel & SLA definitions | Medium–High ⚡ — monitoring systems and reporting | Measures response/resolution times; informs staffing 📊 | Support centers, SLA enforcement, omnichannel support | Clear SLA alignment; helps resource planning and predictability |

| Value for Money / Price Perception Question | Low–Medium 🔄 — question framing and segmentation | Low ⚡ — survey plus competitive price data | Reveals pricing perception and elasticity; competitive insight 📊 | Pricing strategy, promotions, segment pricing analysis | Direct link to revenue strategy; informs pricing adjustments |

| Feature/Functionality Satisfaction Question | Medium 🔄 — many itemized questions possible | Medium ⚡ — combines usage analytics and surveys | Prioritizes roadmap; reveals feature gaps and usability issues 📊 | Product development, feature validation, A/B testing | Provides direct product development input; validates investments |

| Likelihood to Repurchase Question | Low 🔄 — simple intent question | Low ⚡ — periodic post-purchase follow-up | Predicts retention and repeat revenue; leading indicator 📊 | Subscriptions, repeat-purchase forecasting, retention programs | Simple predictor of future purchases; actionable for retention |

| Company/Brand Trust and Credibility Question | Medium–High 🔄 — requires careful scale and context | Medium ⚡ — longitudinal tracking and benchmarking | Measures brand equity and long-term loyalty potential 📊⭐ | Financial, healthcare, regulated industries, reputation management | Signals long-term customer relationships and pricing power |

| Overall Satisfaction / Recommendation Combination Question | Medium–High 🔄 — multi-part survey design | Medium–High ⚡ — broader survey effort and analysis | Holistic customer health metric; combines satisfaction and advocacy 📊 | Periodic comprehensive surveys (annual/quarterly) | Comprehensive baseline for strategy; supports cross-functional alignment |

From Questions to Growth: Activating Your Customer Feedback

You now possess a comprehensive toolkit filled with powerful examples of customer satisfaction survey questions. We've explored the strategic nuances of NPS, the direct clarity of CSAT, and the crucial insights provided by CES. We have delved into everything from product quality ratings to open-ended inquiries, providing a framework for understanding not just what to ask, but why and how.

The journey, however, does not end with a submitted form. Collecting data is merely the first step. The real transformation occurs when you translate those responses into meaningful action. The most successful organisations, from bustling e-commerce sites to local charities, are those that build a systematic process for listening, analysing, and responding to the voice of their customers. This is where raw feedback becomes a roadmap for improvement.

Key Takeaways for Building Your Feedback Engine

Remember, the goal is not just to measure satisfaction but to cultivate it. To do this effectively, focus on these core principles:

- Clarity and Purpose: Every question must have a clear objective. Are you measuring loyalty (NPS), transactional satisfaction (CSAT), or ease of experience (CES)? A well-defined purpose ensures you gather actionable, not just interesting, data.

- The Right Mix: A truly insightful survey balances quantitative and qualitative questions. Rating scales provide measurable benchmarks, while open-ended questions offer the crucial "why" behind the numbers, revealing customer stories and specific pain points.

- Context is Crucial: Timing and placement are everything. A CES question is most effective immediately after a service interaction, while an NPS question might be better suited to a quarterly relationship check-in. Tailor your delivery to the customer journey.

Turning Insights into Your Greatest Asset

Once you have gathered this valuable feedback, the next critical phase begins: activation. Identifying trends is essential for internal improvements, from refining your customer service processes to prioritising your product development pipeline. But what about the positive feedback? The glowing reviews and expressions of delight are pure gold for building trust and credibility.

This is where the feedback loop closes. By systematically collecting and then showcasing your positive customer experiences, you transform satisfied customers into your most powerful advocates. Their authentic praise serves as compelling social proof, reassuring potential customers and reinforcing the value you provide. This isn't just about feeling good; it's a strategic imperative that directly impacts growth, reputation, and customer loyalty. Mastering the art of asking the right examples of customer satisfaction survey questions is the key that unlocks this powerful cycle of continuous improvement and public validation.

Ready to turn your hard-earned customer satisfaction into your most powerful marketing tool? Good Kudos makes it effortless to collect and display beautiful testimonials, transforming positive feedback into a compelling showcase of trust. Start building your free Kudos Wall today and let your happy customers tell your story. Visit Good Kudos to learn more.